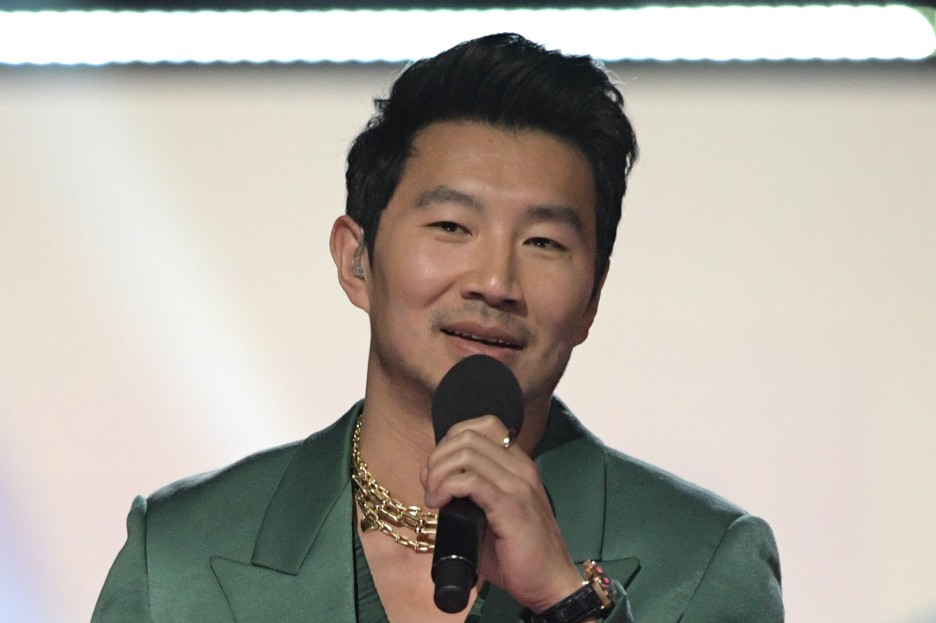

Simu Liu Pledges to Donate the Money He Saves From Donald Trump's Tax Policy: 'I Don't Need a Tax Cut'

Simu Liu, the Canadian actor best known for his leading role in Marvel's Shang-Chi and the Legend of the Ten Rings, is taking a stand against U.S. President Donald Trump's proposed tax policy.

In a recent video message that Liu shared with his millions of followers on social media, Liu pledged to donate any tax savings he receives under the new plan, declaring, "I don't need a tax cut."

Though not an American citizen, Liu lives in the U.S. and pays taxes there, he explained. Alas, his comments highlight his frustration with policies that appear to benefit the wealthy.

"I actually think people like me should probably pay more tax," Liu said, emphasizing the need for economic fairness.

@simuliu hot take; wealthy people should not get tax cuts when most families in america struggle to make a basic living

♬ original sound - Simu Liu

Simi Liu Says He Doesn't Need Trump's Tax Cut

Trump's latest tax proposal builds on the controversial Tax Cuts and Jobs Act (TCJA) from his first term, Daily Hive reported.

That legislation primarily benefited the top 0.1% of earners and major corporations, according to Inequality.org, including those in industries like oil and gas. A corporate tax rate cut from 35% to 21% was one of its main cutouts.

Still, Liu's criticism goes beyond just the tax breaks for the rich.

He expressed confusion over why many middle- and lower-income Americans, whose taxes could increase under the plan, continue to support Trump.

"The cost of living will go up, and their income will go down," Liu said, calling the disconnect between policy impacts and voter support "baffling."

Economists echoed Liu's concerns, pointing out that the proposed extensions and expansions of the TCJA provisions may worsen income inequality.

Research cited by Rolling Stone revealed that most Americans saw minimal benefits from Trump's tax reforms, compared to the significant gains for corporations and ultra-wealthy individuals.

As Trump begins his second term, debates over the tax policy's impact are likely to continue.

How Trump's Tax Cuts Benefit the Wealthy

According to the Center on Budget and Policy Priorities, Trump's 2017 tax law disproportionately benefited the wealthy. Households in the top 1% gained average tax cuts of over $60,000 in a year, compared to less than $500 for those in the bottom 60%.

The policy eroded the U.S. revenue base, with revenues as a share of GDP falling significantly, limiting funds for vital investments and social programs.

Promised economic benefits, such as increased household incomes from corporate tax cuts, largely failed to materialize, with gains concentrated among top executives rather than workers.